A Bloomberg article says the days where Hong Kong expats working in banking or finance enjoy lavished and guaranteed expat housing benefits is fast ending – especially in the wake of layoffs since the start of the year (e.g. Barclays Plc has eliminated hundreds of positions while dozens have been let go at Bank of America Corp. and BNP Paribas SA).

Maureen Mills, managing director of Executive Homes Hong Kong Ltd, a boutique real estate agency that works with law firms, was quoted as saying:

“We are seeing more downsizing. Partners used to have company leases and were happy to spend HK$150,000. Now with cash packages they are more comfortable at HK$80,000 to HK$100,000.”

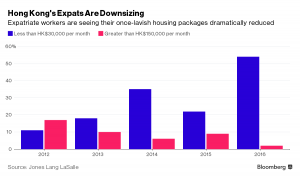

Bloomberg noted that in the first quarter of this year, only 7% of Jones Lang LaSalle Inc’s expat real estate clients in Hong Kong were given monthly rental budgets of more than HK$100,000 – down from 31% in 2012. Now, 54% of clients make do with less than HK$30,000 a month (enough for about two small bedrooms in a 550 square feet condo in Central district) compared with 11% four years ago.

Five years ago, Hong Kong expat housing allowances were often paid on a “use it or lose it” basis – meaning real estate agents had plenty of clients willing to spend as much as HK$300,000 a month. Company-paid leases are now out and expat salaries are adjusted to partially offset for the missing housing allowances. This means that expat employees no longer have an incentive to spend a king’s ransom on rent.

Five years ago, Hong Kong expat housing allowances were often paid on a “use it or lose it” basis – meaning real estate agents had plenty of clients willing to spend as much as HK$300,000 a month. Company-paid leases are now out and expat salaries are adjusted to partially offset for the missing housing allowances. This means that expat employees no longer have an incentive to spend a king’s ransom on rent.

Of course, some top non-banking international executive expats in Hong Kong (e.g. with international fashion houses and global MNCs) are still on full expat packages with housing allowances as high as HK$300,000, paid tuition at international schools for their children and guaranteed repatriation after two or three years.

However, it’s also increasingly common for employers to replace expat packages with quasi-local ones that include a subsidy for housing (e.g. HK$30,000 for a single person and HK$70,000 for a family) for a middle manager expat position.